Fine, solution me honestly: how usually have you found yourself maxing out a bank card, only to turn around and apply for another one? All also usually, when individuals who have a trouble with finding that ‘inadequate funds’ caution when they punch down that credit card for a obtain, they simply get yet another card. Rather than facing the fact they have a bank card problem, they simply maximum out another card.Well, if this explains you, contemplate the option of getting all of those maxed out cards onto one card by acquiring a stability transfer card. Often, you are able to take advantage of decrease fascination charges and costs, plus knowledge other features, such as being waived for the annual charge whenever you spend your statement faithfully every month.When acquiring a harmony transfer credit card, you are able to breathe a little easier when it comes to keeping track of dozens of other cards that have been maxed out, in addition to the regular bills on each card that appears throughout the month. There might be some reassurance comprehending that you just have one bank card statement showing up every month to address.Banks and financing institutions are too conscious of the spending behaviors of several persons nowadays and that their tendency can be to max out the limit of these credit cards. This is the top reason why balance move cards are very popular in the first place and why they are therefore available. So, how will you get one of these brilliant stability move cards?

The bottom line is, first insure that the interest rate is better than usually the one on your overall cards. If not, it will not be value the time and effort, simply because you intend to save money in curiosity fees in addition to merge your credit card debt. Following determining this to be the case, once you sign up for a harmony move card, you are provided the possibility of moving your entire other charge cards to the newest harmony transfer card. Usually these stability offers secure you in to a lower, repaired rate for a period of time; generally six to a dozen months. What a great deal, proper? So, the following problem maybe you are asking yourself is: why do they produce these harmony move cards available?The solution really is easy and boils down to one word: opposition! There are many credit businesses around and they’re all competing for the business. They might well be finding you off the hook by giving you a lower charge and a chance to move all your bank card balances, but they are also betting that you will remain together and that’ll make them your money!

That said, make sure to get into that transaction together with your eyes wide open. If not, you could turn that opportunity to consolidate all of your bank card debt in to a trap. It’s critical to point out that, by using that possibility, it generally does not offer you license to help keep on spending like there is no tomorrow. After all, that is what got you until now in the initial place, and you don’t desire to go backward, proper?Bear in mind that, in order to get complete advantageous asset of any harmony transfer card, you’ve to use it as a tool to show this charge card vessel around. Purpose being, any new balance move card can feature a time restrict on the reduced interest rate and, in the event that you hold maxing out that card, your minimal interest rate can balloon and you can become worse off than before in fascination expenses and charges. Must that occur, you will never get out of bank card jail!

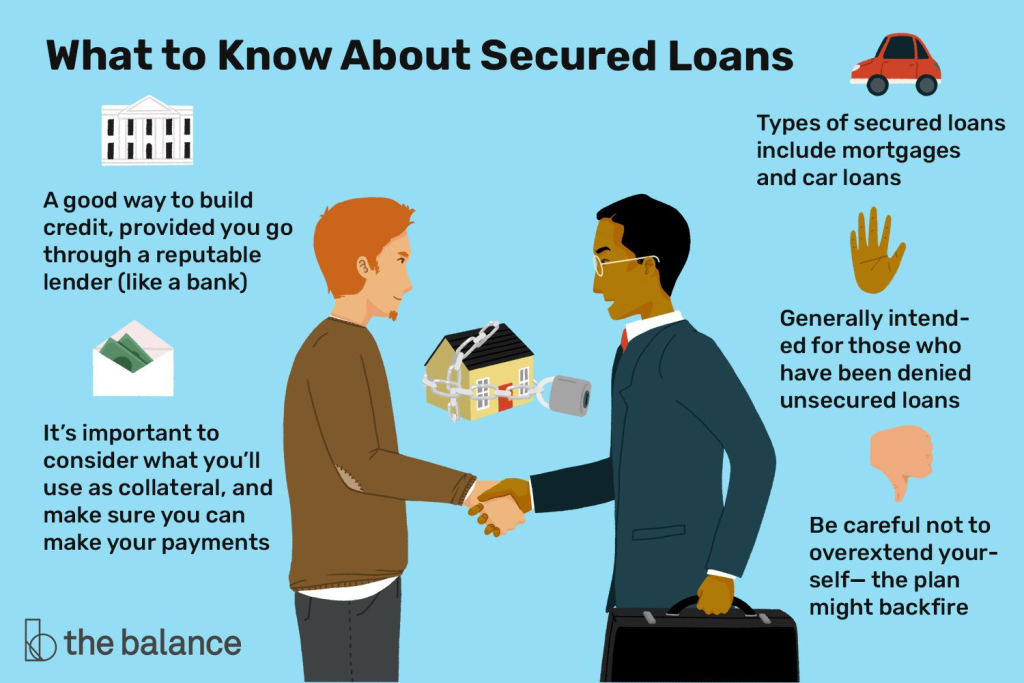

Can be your credit actually bad or you just can’t get accepted for a bank card? A attached charge card can be a great start for you. This kind of card takes a deposit of income added to the card to have accessible paying balance. The deposit protects it and guarantees that the amount of money is there. Whether you’re trying to get a new card or have bad credit and need to begin fresh, you will find advantages to obtaining a attached card.It is now tougher to obtain charge cards these days. You may well be also small and haven’t any credit history, or simply your credit is merely bad. Fortunately, you will find banks and different economic institutions that will provide you with a secured card. A deposit is needed on your own account before it is released to you and produced active. Many banks need a deposit of somewhere between $150 and $300. That only safeguards the institution from loaning you income and losing it. Your credit restrict in your protected card is likely to be what you deposit; nevertheless, there are banks that will put a few hundred dollars or even match your deposit.

Secure credit cards are also being used by many businesses which have employees who run plenty of provisions and require organization money to get things for the office. Secure charge cards are a excellent place to store the money without having to provide employees difficult cash. Several protected cards also earn details as you employ them.The major benefit of these kind of cards is that you cannot review your restrict and that you get a handle on claimed limit. Further, these cards are recognized everywhere and no one call inform that they’re secured. Also, banks report your funds and stability to the important bureaus, consequently supporting your credit. After you have been with a bank for around a year with a secured charge card and in excellent standing, many will offer you an unsecured credit card.

It is very important to look about for an excellent, secure card. Your absolute best choice is to get hold of your bank and see what it needs to offer. Watch for high interest rates, as some cost more than 30%. Also, many banks want or require a monthly annual fee to help keep the card active. You shouldn’t pay an annual charge for a card on that you simply need to deposit money.Getting a secured charge card may possibly not be for everyone. It is a superb way to begin establishing credit if you are young and seeking showing responsibility to a bank. If your credit is poor, then securespend one of these brilliant cards is an ideal way to get your report heading back up and to exhibit a bank you are designed for handling a credit card. The one thing to keep in mind when buying protected card is to find one with a reduced fascination charge that will not charge an annual fee. Most importantly, once you have the card it is smart to be responsible with it and treat it as if it were unsecured and you will have a way to construct your credit standing quickly.Isn’t it fantastic to be financially protected? Having never to be concerned about income and different financing problems? All large and little businesses around the world invest 50% of their time in increasing earnings and profits and the remainder in being worried about its security and security. From business organizations to large types, each is seeking to catch the fantastic chicken named “money security.”

Everyone else includes a different idea of the financial security. For many, having an incredible number of dollars savings is the solution while for others it’s much less. But defining financial protection with regards to attached bank harmony, property and credit is not the right solution since it could lead many of us in thinking it’s out of our reach. But, these things do offer you a feeling of being financially strong but doesn’t actually solve the issue of being financial attached!!

Economic security is obtainable for not only a several but for EVERYONE; all you have to is always to obviously understand and recognize the actual degree of economic security.

What exactly does financial safety mean to corporations and how it can be achieved? Every company generates profits, whether just about, that’s why it is however remaining in the market. This really is where in actuality the planning for economic security comes into focus. The key to maintaining your costs in this way that they offer maximum gains in minimum expenses is the important thing to getting your financial position.Companies which have been affected by the existing World wide economic situation, especially in America, are seriously searching methods to find better answers to reduce their functioning costs. Several companies are start to consider outsourcing finance and accounting solutions as a successful method of cutting prices and obtaining economic security.

What does outsourcing have regarding dilemmas regarding financial safety? Well, Outsourcing your accounting jobs might not merely save you from the concerns of continuous purchase changes, hiring expensive sales and IT specialists, large company space, and different accounting software and machines but in addition helps you in having included accountability and visibility in a great deal more paid off prices! Using outsourced sales services can allow you to save your self a large amount of your expenses. Just the savings on paycheck taxes and advantages alone are tremendous.A badly-handled sales division can cause serious harm to the financial problem of a company. Subsequently it’s obvious why several organization owners prefer to change this monotonous burden to the outsourcer, ergo increasing economic safety when it comes to decreased costs.

If you intend your sales function in the proper way, economic safety will remain close-by while financial disaster will remain far-off from you and your business. You are able to plan your finance is likely to unique way however the guidance of an economic accounting planner is significantly more productive.Financial security is within the reach of anybody having a need to boost their financial condition, whether it’s a person or a business. All it needs a bit of discipline. If you are one of the seekers, look number further. There are companies to supply you whole selection of economic and accounting planning alongside money management services. But sure, most important of all is to choose the correct one for you personally, for example you’ll find prime accounting firms in Virginia or best sales firms in Virginia by visiting them on line and having a glance at their perform that they did as sales services for startups in Virginia and for corporate segment there.